Securing Long-Term Innovation for the Financial Services Industry

Efthymios Kartsonakis

Competency Director - Connected Services

The financial services industry is undergoing an urgent digital transformation that’s driven by remote work, ambitious ESG commitments, and the need to cut costs while innovating. Traditional institutions are continuously being challenged by new technologies such as AI and machine learning, digital identity, and edge computing, which disruptors are using to adapt to consumers’ evolving preferences at an unprecedented rate. At the same time, the sector is being highly targeted by increasingly sophisticated cyber attackers. According to recent studies, financial institutions have suffered $12 billion in losses over the last decade.

Despite all these challenges, the industry continues to innovate, grow, and retain consumer trust. In this article, we explore three recent examples of this innovation in practice and share advice for innovating securely using modern application development processes, security architecture, and real-time data for proactive protection.

Pay.UK: Innovating to Protect Millions of Consumer Transactions

The Pay.UK Authorised Push Payment (APP) platform facilitates £7.2 trillion. It was created to address APP fraud and deliver an improved and secure experience for end users. Pay.UK collaborated with the industry to design, implement, and support a closed ecosystem whereby Payment Service Providers (PSPs) will reimburse fraud victims within five working days as per the revised Payments Service Regulator (PSR)requirements.

A trusted directory and API platform built around out-of-the-box components offers reliable interbank discovery and routing capabilities for payment providers. The platform also provides a scalable and secure approach to massive-scale transactional requests, utilizing transport and signing certificates for bank-to-bank interactions, ensuring message integrity and transport-level security. From the payment providers’ point of view, the platform restores trust in financial transactions, which is fundamental, not only to the functioning of the economy, but also to the continued growth and adoption of digital payment systems.

Regulatory requirements are constantly evolving and this platform enables Pay.UK and the industry as a whole to be more nimble and adapt quickly.

Pensions Dashboards Programme: Innovating for Nation-Wide Pension Visibility

Like the APP Reimbursement Scheme, the UK’s Pensions Dashboards Programme (PDP) is a prime example of a digital ecosystem wherein government agencies, financial services institutions, and citizens are able to participate and interact securely by leveraging the capabilities of an Identity and Access Management (IdAM) platform and financial-grade APIs.

People in the UK can accumulate over 11 pension pots over the span of their career. This leads to billions of pounds in unclaimed funds and makes it hard for employees to plan their retirement. PDP provides a platform that simplifies the public’s relationship with their retirement savings, reconnecting them with lost pension pots and allowing them to view their pension details securely in one place.

Venture Capital Firm: Innovating to Enhance Investment Decision Making

Ensono recently worked with a prominent US venture capital firm that faced challenges managing their vast repository of historic, unstructured investment data, making extracting key insights and trends from previous investments difficult. They had a substantial portfolio of potential investments and needed a more analytical and fact-based approach to conducting investment research. We started by delivering a six-week “AI Innovation Lab”, where our experts and the client’s team collaborated to experiment with cutting-edge AI technologies to engineer a working proof of concept. This included deploying a vector store to organize their historic unstructured investment data. The delivery outcome followed was a secure chatbot framework for better data retrieval, a standardized analysis framework, and the integration of machine learning capabilities to enhance adaptability and learning.

Ultimately, this work drove a cultural shift towards data-driven decision making for the organization and established an evolving data platform with a skilled in-house team to sustain value.

Lessons

In our experience, successful digital strategy implementation goes hand-in-hand with a well-executed cloud migration strategy. The opportunity to build new infrastructure and processes on modern architectures that are flexible, scalable, and highly available leads to significant development and operational benefits, while allowing organizations to avoid costly incomplete digital transformations.

- Modern Application Development Boosts Agility

Modern application development frameworks such as Agile and TOGAF (The Open Group Architectural Framework) Enterprise Architecture allow organizations to deliver adaptable and secure solutions faster than traditional approaches. Agile enterprise architecture provides a comprehensive, top-down framework, defining business goals and aligning architectural objectives to drive measurable business value. This approach underscores the importance of driving decisions from business objectives rather than technology alone, ensuring a clear architectural vision from the outset.

The “5 R’s” view of modernization—Rehost, Refactor, Rearchitect, Rebuild, and Replace—helps organizations prioritize their challenges and goals to enable sustainable innovation. Many financial institutions find that a microservices architecture complements these modernization efforts, enabling teams to build and deploy applications as loosely coupled, independent workloads. This enhances agility, scalability, and fault tolerance, which are essential for organizations facing rapid industry evolution. - Invest Equally in Security and Innovation

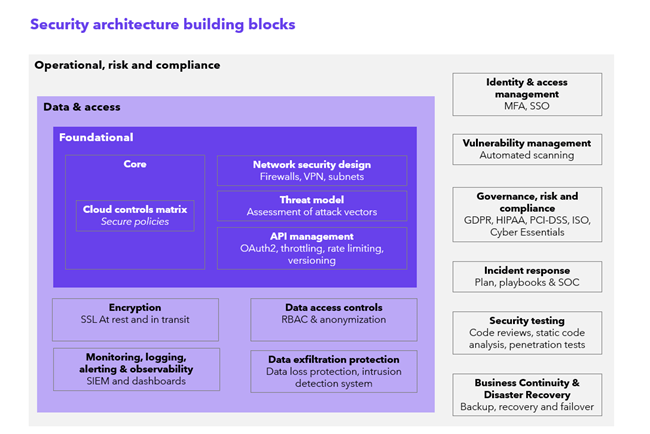

Security and innovation are not mutually exclusive when it comes to building the foundations of a new proposition. Instead, organizations should invest in both simultaneously to deliver value to their clients safely and effectively. The following diagram illustrates core security architecture building blocks.

- Leverage Real-Time Data for Proactive Protection

The future of financial-grade API adoption looks promising, as it offers enhanced security standards and robust data protection protocols initially designed for financial services. Data streaming and analytics enable organizations in highly regulated industries to process and analyze vast amounts of real-time transactional data. This ingestion happens over secure (financial grade) API gateways to prevent unauthorized access. Upon ingestion, organizations can leverage machine learning models and behavioral analytics to detect anomalies and respond to potential issues, including fraud and breaches, in milliseconds.

Collaboration is the Financial Services Industry’s Greatest Strength

Bringing experts from the public and private sectors together and using open industry standards and APIs is what enables secure innovation across the industry. This collaboration fosters a culture of shared knowledge and best practices in security and user experience, leading to numerous opportunities for growth and innovation.

These “innovation clusters” can further enhance the ability of financial services institutions to offer new products to their customers while building trust. For example, a platform built on well-designed cloud-native security and microservices foundations will serve financial organizations well into the future as they increasingly turn to AI to automate processes, identify trends, and increase agility to sustain ongoing innovation and long-term growth.

By investing in strong, collaborative ecosystems and modern technological frameworks, financial services organizations can create robust foundations for innovation that align with the industry’s unique needs. As institutions adapt and grow, these frameworks ensure that they can continue delivering secure, efficient, and scalable solutions to meet future demands.

Social Share

Don't miss the latest from Ensono

Keep up with Ensono

Innovation never stops, and we support you at every stage. From infrastructure-as-a-service advances to upcoming webinars, explore our news here.

Blog Post | April 14, 2025 | Technology trends

IBM z17: The Age of AI on The Mainframe Has Arrived. Are You Ready to Meet It?

Blog Post | March 19, 2025 | Industry trends

The Hidden Costs of Legacy Data Centers – Are You Paying More Than You Realize?

Blog Post | March 7, 2025 | Industry trends